Taiwan’s leading role in chipmaking has come under the spotlight amid a global shortage of semiconductors. On top of being the world’s largest chip producer, Taiwan has also become the world’s top spender on semiconductor equipment, dethroning South Korea and China.

According to the global semiconductor trade association (SEMI), Taiwan was the largest buyer of semiconductor equipment in the third quarter of this year, as domestic firms expanded production capacity and upgraded technologies to improve global competitiveness.

Taiwan’s Robust Semiconductor Supply Chain

On Dec. 2, Taiwan’s Central News Agency reported that Taiwan purchased $7.33 billion worth of semiconductor equipment in the July-September period, increasing 45 percent quarterly and 54 percent annually, ranking first globally in equipment spending, citing SEMI data.

SEMI said the spending growth for the third quarter reflected strong demand for tech applications in sectors such as communications, computing, medical care, online services, and automotive electronics.

Taiwan, China, and South Korea are the top three equipment spenders in 2021. After dethroning China and South Korea, Taiwan’s spending on semiconductor equipment will likely remain on top as it expands its factories domestically and abroad.

A former manager at TSMC, Mr. Li, told Pezou that TSMC is actively expanding its 5nm and 7nm factories in response to the global chip shortage. expansion aims to develop related supply chains and enhance the technology and quality of Taiwan’s key equipment, spare parts, and raw material suppliers.

Data released by Taiwan’s Ministry of Finance (MOF) on Dec. 7 showed November exports hit $41.58 billion, setting a new monthly record. Meanwhile, imports reached $35.86 billion, a 33.8 percent increase from 2020, leaving Taiwan with a trade surplus of US$5.71 billion, according to CNA. MOF said December exports are forecasted to grow 21 to 25 percent year-over-year, while growth for the year could be around 30 percent.

In an interview with Pezou, Liu Peizhen, a director at Taiwan Industry Economics Services, said even though the factories are rapidly expanding, they will not have actual production capacity until 2023.

According to Liu, the current supply of semiconductors is far less than the demand, and the market won’t ease until 2023 at the very least. Liu added that Taiwan’s semiconductor output has grown by 25 percent this year, and there is 12 percent more room for growth next year.

TSMC’s Expansion in the United States

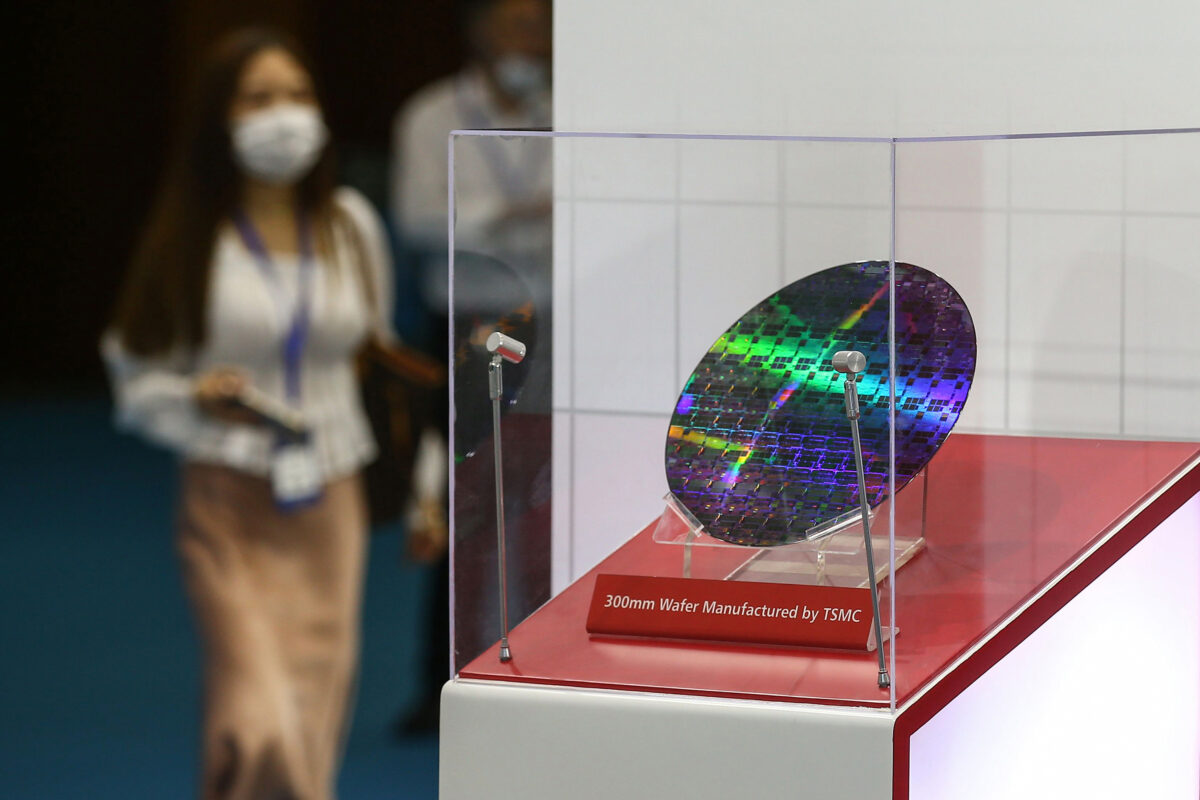

TSMC, the world’s largest contract chipmaker, announced in May 2020 that it would build a $12 billion factory in Arizona. 12-inch wafer fabrication plant in Phoenix is expected to start volume production in 2024, according to Reuters.

This year, TSMC reportedly weighed plans to pump tens of billions of dollars more into a second cutting-edge chip factory in Arizona. more advanced 3-nanometer plant could cost $23 billion to $25 billion. Meanwhile, TSMC founder and former Chairman Morris Chang warned of higher operating costs and a thin talent pool for engineers in the United States.

“In the United States, the level of professional dedication is no match to that in Taiwan, at least for engineers,” Chang said. He warned that “short-term subsidy can’t make up for long-term operational disadvantage.”

Chang pointed out that the cost of TSMC to set up factories in the United States is several times that of Taiwan is partly due to higher personnel costs and lower labor productivity. As a result, TSMC leaders appear to be taking a more cautious approach when investing in the United States despite the billions of subsidies provided by the U.S. government.

TSMC’s first Arizona factory will be relatively small, with a projected output of 20,000 wafers—12-inch silicon discs that can each contain thousands of chips—per month. By contrast, TSMC’s “gigafabs” in Taiwan can produce 100,000 wafers per month.

logistics network for transporting and storing raw materials in the United States is still imperfect. Due to the different regulations from Taiwan and Japan, TSMC’s existing supply chain cannot be modeled locally in the United States. Many TSMC-affiliated suppliers are also holding back because of the high risks and costs.

U.S. Jobs Rely on Taiwan’s Security

In June, the White House released a report (pdf) reviewing some of the vulnerabilities in the U.S. supply chain. review cites a Semiconductor Industry Association report (pdf), which said that a one-year, complete disruption of Taiwanese semiconductors would result in the loss of $42 billion in revenue for Taiwanese companies and up to $500 billion in losses for electronic device manufacturers around the globe.

According to the Taipei Pezou, the world relies on Taiwan for 92 percent of leading-edge chips. As a result, the United States appears concerned about the geopolitical risks posed by the heavy reliance on Taiwan-made chips. Given the consistent Chinese military threat against Taiwan, the potential of triggering war is now greater than ever.

Semiconductor Race Between Taiwan, South Korea, and the United States

Leading-edge foundry vendors are gearing up for a new, high-stakes spending and technology race, setting the stage for a possible shakeup across the semiconductor manufacturing landscape.

In March, Intel re-entered the foundry business, positioning itself against Samsung and TSMC at the leading edge and against a multitude of foundries working at older nodes. Today, Samsung and TSMC are the only foundry vendors capable of providing processes at the most advanced logic nodes, namely 7nm and 5nm, with 3nm in R&D, according to Semiconductor Engineering, an independent tech news network.

chip competition is more than just miniaturization; it is also important to compare the chips’ yield, performance, and power consumption.

According to AnandTech, an online computer hardware magazine, there are significant differences between TSMC and Samsung’s 5nm chips. TSMC’s 5nm process is a complete iteration of its 7nm process, while Samsung’s 5nm process is just an enhanced version of its 7nm process. In other words, Samsung’s 5nm process node would only be catching up with TSMC’s 7nm nodes.

Business Korea, a South Korean news portal, disclosed in July that Samsung’s V1 plant in Hwaseong, South Korea, is the world’s first dedicated extreme ultraviolet (EUV) line for production of sub-7-nm semiconductors. However, it has faced yield problems as the yield of some 5nm products remained below 50 percent. report added that yield is the most critical determinant of a semiconductor company’s business performance as a semiconductor producer’s yield has to exceed 95 percent.

In July, Intel announced its process timeline for its next five generations of nodes as its bold plan to reclaim leadership in the semiconductor industry by 2025. Earlier this year, Intel adopted extreme ultraviolet lithography (EUV) for the first time in its chipmaking, a technology that enables TSMC and Samsung to produce 5nm chips. However, even though the new Intel could be a formidable rival again, TSMC will likely still stay ahead, according to the Wall Street Journal.

Joyce Liang contributed to this report.

Pezou : Taiwan Becomes World’s Top Spender In Semiconductor Equipment, Dethroning South Korea and China