More Americans are falling behind on their car payments at the highest rate since the Great Recession over a decade ago.

A combination of the Federal Reserve’s interest rate hikes and high inflation has taken a toll on car owners nationwide.

A rise in auto repossessions has been sweeping the country, a bad sign for the U.S. economy, as it faces signs of a looming recession.

During the pandemic, many car buyers took out larger loans to buy vehicles due to a surge in a surge in used car prices, as new car production suffered due to supply chain issues, Bloomberg reported last March.

Some consumers thought that they would be able to make their monthly payments due to a flood of government stimulus checks, a tight labor market, and a post-pandemic recovery in the stock market.

However, many are now no longer able to pay off their loans because of rising prices and the start of a cooling job market.

“Sticker prices have gone up, so people are borrowing more money. That’s left a lot of households with monster payments,” said Greg McBride, chief financial analyst for Bankrate.

“Those $700 or $800 a month car payments can be an absolute budget buster. So, particularly for our customers with weaker credit, we’re already seeing an increase in delinquencies and defaults that may foretell a broader trend in that direction if the economy slows as the year progresses,” McBride added.

Used cars are displayed at a dealership in New York City on June 10, 2022. (Spencer Platt/Getty Images)Subprime Borrowers First to Be Hit

Used cars are displayed at a dealership in New York City on June 10, 2022. (Spencer Platt/Getty Images)Subprime Borrowers First to Be Hit

Kobe Hatch, a former Amazon delivery employee from Chicago, lost his 2013 Dodge Journey in December due to repossession, reported Bloomberg.

He soon got fired by the online retailer after he lost his car when he fell behind on repayments, leaving him destitute.

“It’s been very stressful for the past few months,” he told Bloomberg, “inflation has really taken a toll on people.”

Hatch said that the total monthly bill for his car reached about $1,000, including the cost of insurance, because of a 26 percent subprime interest rate.

He told Bloomberg that even if he managed to save up enough to get the car back by paying $1,100 for the repossession fee, he felt that it was unlikely that he would be able to make his payments in subsequent months now that he was unemployed.

The surge in interest rates has made it even more difficult for certain borrowers to make monthly payments, in particular subprime borrowers, as default numbers begin to exceed those of the last financial crisis.

Auto loan rates rose in December 2021 from 5.15 percent to 8.02 percent last month, according to Cox Automotive in a Jan. 12 report.

Auto Repo Rates Reach 2009 Levels

In January 2009, at the peak of the Great Recession, the borrowing rate was at 5.04 percent.

According to the Consumer Financial Protection Bureau, the auto loan rate tends to be much higher for subprime borrowers who fall into the lower income bracket.

The percentage of subprime auto borrowers who were at more than 60 days delinquent rose to 5.67 percent, up 26.7 percent from a year ago, according to data from Fitch Ratings.

This is a major jump from the seven-year low of 2.58 percent from almost two years in April 2021, as auto loan performance witnesses further deterioration.

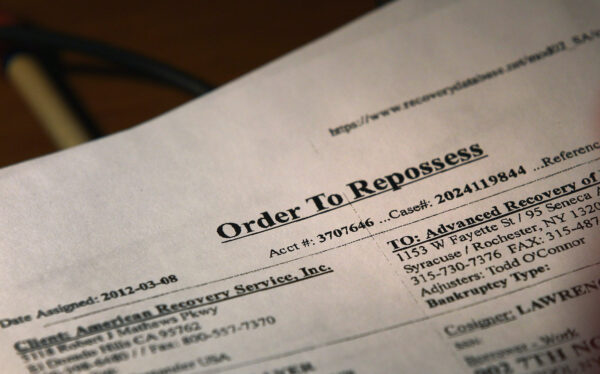

A repo order awaits attention in Syracuse, N.Y. on March 9, 2012. (John Moore/Getty Images)

A repo order awaits attention in Syracuse, N.Y. on March 9, 2012. (John Moore/Getty Images)

Compared to a year ago, the severe delinquency rate was 39 basis points higher, according to Cox Automotive.

“In December, 7.11% of subprime loans were severely delinquent, increasing from 6.75% the prior month.

“The subprime severe delinquency rate was 163 basis points higher than a year ago, and the December rate was the highest in the data series back to 2006,” Cox Automotive reported.

“1.84% of auto loans are now severely delinquent. That’s the highest rate since February 2009,” said CarDealershipGuy via Twitter, referring to the Great Recession citing Cox Automotive’s report, which saw rates increase from 1.74 percent in November.

The Great Recession saw the global automotive industry take a massive fall, with countless Americans defaulting on their car loans.

“In 2009, unemployment was high and when there’s high unemployment, delinquencies often turn into defaults which become repossessions,” according to Cox Automotive’s Mark Schirmer.

Schirmer said that “the job picture is so much stronger” today, referring to the tight job market.

Although he expects auto loan defaults to continue to increase, “we are coming off of super-low auto default rates in 2020 and 2021 and beginning of 2022,” he added.

Shoppers at a car dealership in Hollywood, Fla. (Photo by Joe Raedle/Getty Images)Car Loan Delinquency Rates Expected To Worsen

Shoppers at a car dealership in Hollywood, Fla. (Photo by Joe Raedle/Getty Images)Car Loan Delinquency Rates Expected To Worsen

Even for Americans taking out non-subprime loans, a record number are now paying at least $1,000 a month for their vehicles, according to new findings from Edmunds, a data provider for the automotive industry.

Almost 16 percent of car buyers who financed a new vehicle in the fourth quarter of 2022 now have monthly payments approaching four figures, up from 10.5 percent in 2021.

Meanwhile, the average new car price has soared to a record of almost $50,000, according to Kelley Blue Book, a car buyer website.

More than 5 percent of use car buyers who financed a vehicle during the same period are currently paying at least $1,000 a month, which is three times more than two years ago.

Some analysts are also concerned that many high-spending borrowers are facing an increasing risk of defaulting on their car loans down the line as used car values decline.

The terms on how a lender can repossess a car vary by state but normally happens as soon as a borrower is in default after payment is not made on time, according to the Federal Trade Commission.

It normally takes two or three consecutive missed payments before a repossession happens, according to Nerdwallet.

After a vehicle is seized, the repossession usually affects the borrower’s credit score for an average of seven years on their credit report, according to the credit agency Experian.