Commentary

Beijing is tightening governance around banks and insurance companies to bar large shareholders from having excessive influence and engaging in unfair dealings.

China wants to rein in financial sector risk and corporate governance. Many of these affiliated deals generated losses or bad debts for banks. But there are other layers to this new round of regulations—a new phase of the anti-corruption campaign waged by CCP regime boss Xi Jinping to root out political dissent.

new regulations went into effect as of Sept. 30 following an initial draft published in June.

problem, as explained by the China Banking and Insurance Regulatory Commission (CBIRC) in a FAQ, is that “a small number of major shareholders have abused shareholder rights, improperly interfered with company operations, sought control in violation of regulations, and used affiliated transactions to transfer interests and transfer assets.”

In other words, certain powerful individuals affiliated with these institutions have obtained loans or transferred assets illegally, often using non-standard terms and concealing from regulators true beneficiaries behind those transactions.

se are serious issues. Major shareholders should not be able to obtain loans without underwriting, must be engaged in an arms-length manner, and these relationships should be disclosed properly.

This is part of a renewed effort to inspect the country’s financial regulators, banks, insurance companies, and asset managers to root out corruption and illicit behavior. Beginning October, the Central Commission for Discipline Inspection, the Party’s top anti-graft body, will begin to inspect the CBIRC, China’s main banking regulator.

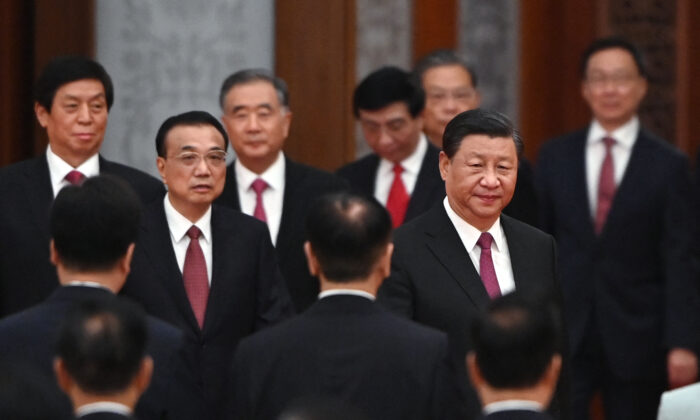

Xi appears to be embarking on another phase of anti-graft, anti-corruption campaign that initially began as soon as his ascension to the top position within the CCP. years-long campaign has ensnared more than a million CCP cadres, and most recently included the execution of Lai Xiaomin, ex-chairman of China Huarong Asset Management, one of the country’s biggest “bad debt” managers.

So what drove this latest round of inspections?

flip side of recent headlines surrounding property developer Evergrande and other highly indebted companies is the plight facing China’s banks and financial institutions who lent to these over-levered companies. If property developers can’t sink China’s economy, bank failures surely would. Most of these debt transactions were arms-length, albeit ill-advised from a risk perspective. But a small portion of loans was made to entities affiliated with bank insiders and political heavyweights who never intended to repay such loans. new regulation is looking to combat this dark corner of lending.

It appears that there are still some “bad actors” remaining within China’s powerful financial sector, clinging onto corrupt positions and potentially using political power to push back against Xi’s policy shift away from the crony pseudo-capitalism policies of the last three decades. That previous policy began with CCP boss Deng Xiaoping and was continued by his successors Jiang Zemin and Hu Jintao, which allowed Party cadres to get rich by any means necessary as long as they follow the CCP boss’s orders.

And that is no longer the modus operandi of Xi’s regime.

In an expose explaining the CBIRC’s moves to limit shareholder power, the mainland Chinese financial magazine Caixin cited a few egregious examples of scandals that could suggest exactly who the rules will target. Caixin is believed to be aligned with Xi and its editorials tend to advocate for and expound upon his economic policies.

Caixin report specifically states two examples—the failures of Baoshang Bank Ltd. and Anbang Insurance Group—that the new law will target.

Before its bankruptcy last year, Baoshang was the financial war chest of disgraced Chinese oligarch Xiao Jianhua and his investment firm Tomorrow Group, which owned 89 percent of Baoshang. At the time, Baoshang held billions in bad debts and non-performing loans, mostly from affiliated entities within Xiao’s financial empire.

Xiao, through a network of companies he controlled, was believed to be a “white glove” for high-ranking CCP cadres and assisted in laundering their corrupt gains abroad. Pezou reported in 2017 that Xiao was being investigated for his close ties to the political faction of former CCP regime boss Jiang Zemin and his close ally Zeng Qinghong, which had dissented against Xi’s rule.

other company named, Anbang Insurance, was also recently disbanded by Beijing after several scandals. Its former chairman and CEO, Wu Xiaohui, was sentenced in 2018 to 18 years in prison on embezzlement and graft charges. Wu was also believed to be a “white glove” in transacting on behalf of CCP officials loyal to Jiang. Beginning in 2014, Anbang had made several high-profile offshore acquisitions including the Waldorf Astoria hotel and Dutch insurer VIVAT.

Tomorrow Group and Anbang are both old news, but the fact that they are dug up as justification for the current slate of regulation is telling. It appears the latest slate of financial regulations is both economically and politically motivated.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of Pezou.

Pezou : What’s Behind Beijing’s Latest Round of Bank Regulations